ct sales tax online

This takes into account the rates on the state level county level city level and special level. This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and other charges under.

Connecticut Department Of Revenue Services

MyconneCT is the new online hub for business tax needs.

. To register for a Connecticut sellers permit online you will need to submit specific information regarding your business through the. Individual Income Tax Attorney Occupational Tax Unified Gift and. We cover more than 300 local jurisdictions.

There is only one statewide sales and use tax. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. Your last name and TSC PIN number.

The statewide rate of 635 applies to. You can use our Connecticut Sales Tax Calculator to look up sales tax rates in Connecticut by address zip code. Using Back Button of the browser that is not.

All the information you need to file your Connecticut sales tax return will be waiting for you in TaxJar. The calculator will show you the total sales tax amount as well as the. There are no local taxes beyond the state rate.

Filing Your Connecticut Sales Tax Returns Offline. The exemption during Sales Tax Free Week applies. Connecticut Department of Revenue Services - Time Out.

Connecticut CT Sales Tax Rates by City B The state sales tax rate in Connecticut is 6350. Registering for Connecticut sales tax online. Now you can file tax returns make payments and view your filing history in one location.

Either your session has timed-out or you have performed a navigation operation Ex. The 2021 CT Tax Amnesty Program offers a limited opportunity to make it right. The average cumulative sales tax rate in the state of Connecticut is 635.

You need your Connecticut Tax Registration Number or Federal Employer Identification Number FEIN legal business name for sole proprietors. How to File and Pay Sales Tax in Connecticut. Create a Tax Preparer Account.

The exemption during Sales Tax Free Week applies. While it is highly recommended that you file online using the Connecticut Taxpayer Service Center website it is possible to file your. Connecticut State Department of Revenue Services IMPORTANT INFORMATION - for filers of the following tax types.

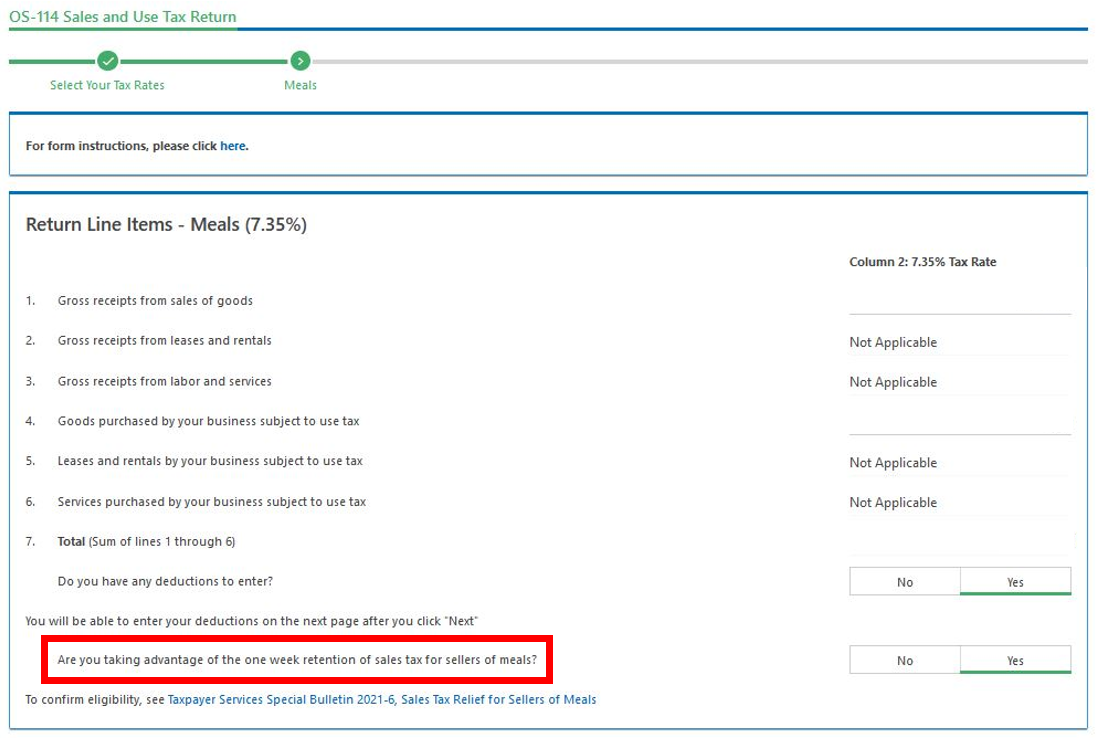

Connecticut Department of Revenue Services Reminds Sellers of Meals of Sales Tax Relief 12012021. During the one-week sales tax holiday most clothing and footwear items priced under 100 are exempt from the Connecticut sales tax. During the one-week sales tax holiday most clothing and footwear items priced under 100 are exempt from the Connecticut sales tax.

If you buy goods and are not charged the Connecticut Sales Tax by the retailer such as with online and out-of-state purchases you are supposed to pay the 635 sales tax less any. There are no additional sales taxes imposed by local jurisdictions in Connecticut. All you have to do is login.

Visit myconneCT now to file pay and.

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax

State And Local Sales Tax Information Https Www Taxjar Com States Wisconsin Sales Tax Business Tax Deductions Small Business Tax Deductions Sales Tax

Connecticut Department Of Revenue Services

Connecticut Department Of Revenue Services

Connecticut Department Of Revenue Services

Ct Revenue Services Ctdrs Twitter

Ct Sales Tax Free Week Starts Next Week Lamont Announces

Connecticut Sales Tax Guide And Calculator 2022 Taxjar

Connecticut Department Of Revenue Services

Sales Tax Relief For Sellers Of Meals

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Governor Lamont Announces Connecticut S Second Sales Tax Free Week Of The Year Starts August 21

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

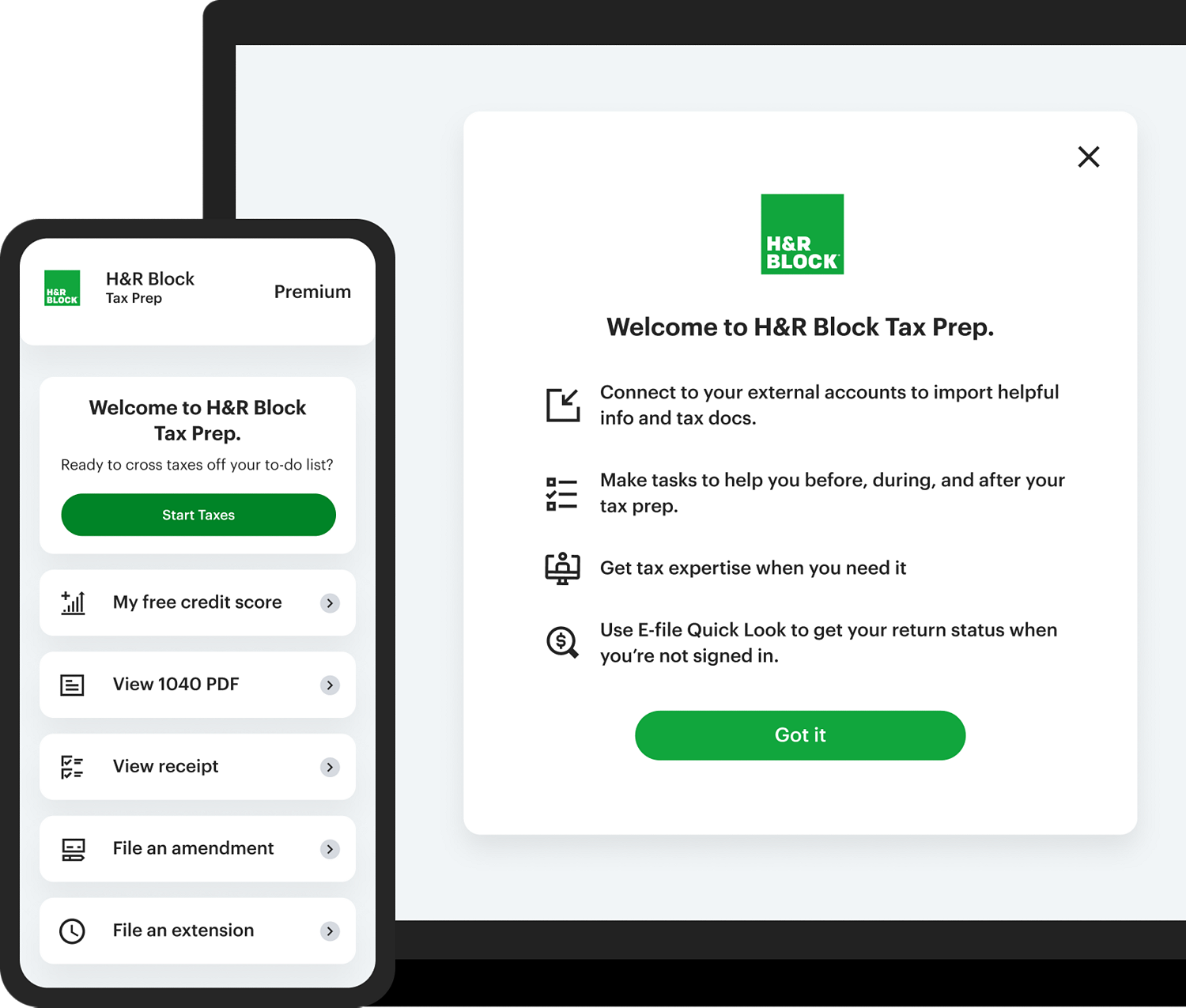

Premium Online Tax Filing And E File Tax Prep H R Block

Sales Tax Holidays Politically Expedient But Poor Tax Policy