tax identity theft description quizlet

A Quiz for Consumers Identity thieves use many ways of getting your personal financial information so they can make. When it comes to tax-related identity theft the Internal Revenue Service wants to resolve your case as quickly as possible.

Learn More About A Tax Deduction Vs Tax Credit H R Block

Learn vocabulary terms and more with flashcards games and other study tools.

. Criminals send these claims to the Internal Revenue Service IRS using stolen personal details such as your social security. Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return. More from HR Block.

Tax identity thieves steal. People often discover tax identity theft when they file their. Identity theft definition When someone wrongfully acquires and uses a consumers personal identification credit or account information Three examples of how identity thieves acquire.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent. Start studying Identity Theft Test. In the early days.

Cyber identity may differ from a persons actual offline identity. All identity theft is a crime under California law but criminal identity theft refers to one type of the crime. This happens if someone uses your Social Security number.

Estimates are that this form of fraud costs consumers 52 billion each. - Tax identity theft is the use of someone elses personal information to file a fraudulent tax return or claim tax benefits - Tax ID fraudsters file early because they have stolen personal. Data Breach An incident in which sensitive protected.

Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. Equipped with three simple ingredients a name birthdate and Social Security number. This Identity Theft shows itself through fraudulent tax refund claims.

The IRS has worked hard to help victims of identity. What Is Tax Identity Theft. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return.

The identity thief will use a stolen Social. Identity theft is when a thief gains access to your personal information identity fraud describes a crime in which a thief creates a fictitious person impacts of identity theft include -hurting job. Criminal identity theft occurs when someone cited or arrested for a crime uses.

Tax ID theft was the biggest form of ID fraud reported to the Federal Trade Commission in 2014. Tax return identity theft is the act of filing a return using a stolen identity and taking the victims refund. Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work.

Identity Theft Quiz Identity Theft Quiz Identity Theft Quiz. Tax identity theft is a large-scale problem in the United States due to an increase in cyber attacks on employers insurers payroll service providers universities and retailers. Phishing and Online Scams.

The IRS state tax agencies and private industry partner to detect prevent and deter tax-related identity theft and fraud. Tax identity theft whether its with the Internal Revenue Service or your states Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve. A form of identity theft in which someone steals the identity and sometimes even the role within society of a recently deceased individual.

The personalityies that is created through a persons online interactions. Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund. The IRS doesnt initiate.

Cpa 20 Your Federal And State Income Taxes Flashcards Quizlet

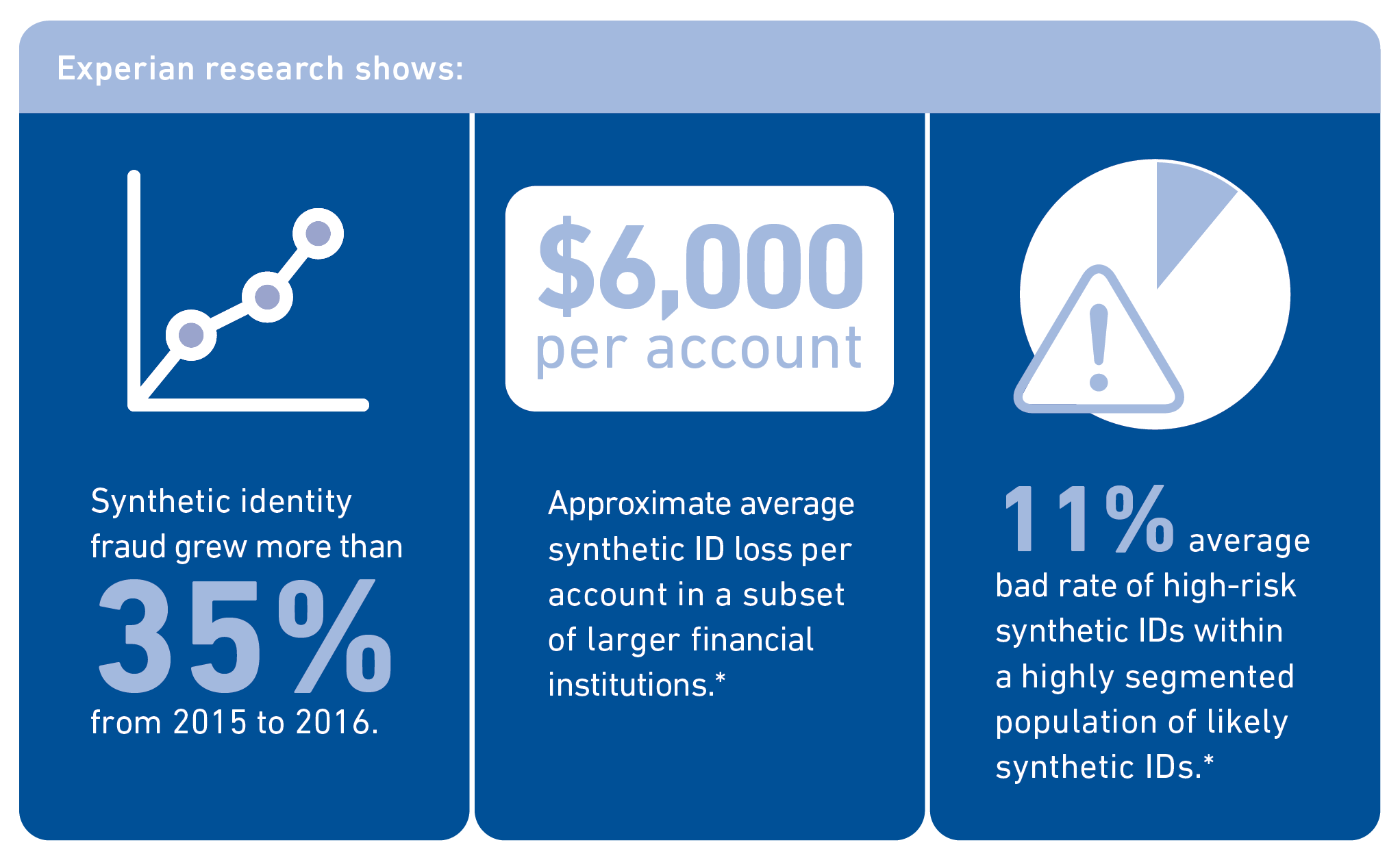

Identity Theft Statistics Experian

Get Monthly Payday Loans Are The Great Aid For The Poor Creditor As They Get Rid Of Their Tension Of Fin Payday Loans Loans For Bad Credit Instant Payday Loans

Your Guide To Prorated Taxes In A Real Estate Transaction

Service To Taxpayers Internal Revenue Service

Everfi Definition Flashcards Quizlet

How To Fill Out Irs Form 1040 For 2020 Youtube

Free File Can Help People Who Have No Filing Requirement Find Overlooked Tax Credits Internal Revenue Service

Identity Theft Flashcards Practice Test Quizlet

Experts Think That Up To 35 Of Your Credit Rating Is Based On Your Paying Of Costs On Time So Thi Credit Repair Business Credit Repair Credit Repair Services

Another Irs Tax Scam Get Certified Get Ahead

Form 8915 E For Retirement Plans H R Block

W2 W4 Form 1040 And Credit Card Terminology Flashcards Quizlet

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)